The Bank of Africa (BOA)-Ghana, in partnership with the International Finance Corporation (IFC), a member of the World Bank Group, has launched an innovative project to train about 1000 Small and Medium-sized Enterprises (SMEs) across Ghana, with a special focus on women-led businesses.

The collaboration between BOA, and IFC is the first of its kind in the country for economic empowerment of targeted groups.

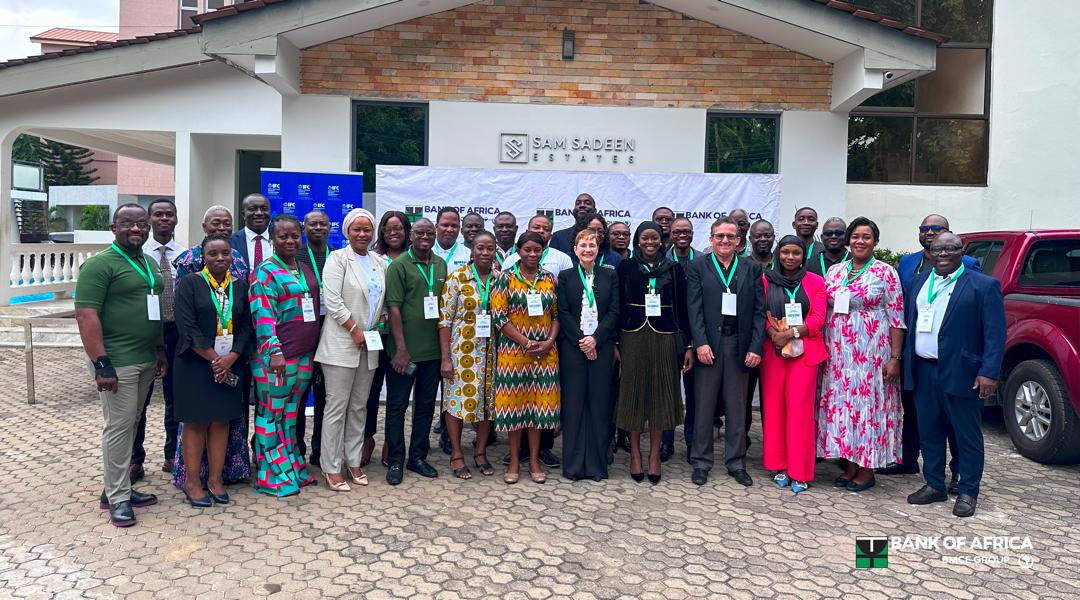

The inaugural edition of the BOA/IFC SME Seminar, held in Accra, brought together about 50 participants from various SMEs for an interactive and engaging two-day training session.

The year-long programme is open to customers and non-customers of the bank, particularly the women’s wing of the Ghana Union of Traders’ Association (GUTA) in all 16 regions.

Managing Director, BOA-Ghana, Abderrahmane Belbachir, speaking at the inaugural training seminar, emphasised that this training programme is the starting point of the bank’s comprehensive strategy to support SMEs in Ghana.

“We recognise that access to capital is crucial, but true empowerment goes beyond financial resources. That is why we have designed this programme to equip you with the essential skills and knowledge to propel your businesses forward.

“This training is a great avenue to open doors to more opportunities with the Bank of Africa. We are prepared to support your growth with access to more loans, facilitation of your transfer requests, and other tailored financial solutions,” he said.

The MD of BOA reiterated that the partnership exemplifies the power of shared vision and collective action in driving economic development.

“To our partners, your continued trust and collaboration with the Bank of Africa Ghana have made this initiative possible,” he added.

SME Coordinator, BOA-Ghana, Jacob Wilberforce highlighted the pivotal role of SMEs in fueling economic growth in Ghana.

He said the bank has a dedicated segment that focuses on supporting businesses and offering them very soft loans with interest lower than the Bank of Ghana’s reference rate.

“Beyond financial assistance, we provide advisory services, business networking opportunities, and workshops to empower SMEs to thrive and expand their operations. This partnership further strengthens our commitment effort to impact more businesses,” he said.

Mr. Wilberforce added that tailored financial services have been developed to meet the unique needs of these dynamic entities that will benefit from the partnership. “Through our SME Support Facility (SSF), we offer collateral-free loans from a minimum of GHS20,000 to as high as the client capacity can handle,” he stressed.

IFC-LPI Certified Assessor and Performance & Learning Specialist, Margaret Jackson, who was the main facilitator of the training highlighted that participants will be well equipped on business generating profits, measuring business profitability, and developing strategies to enhance profitability after completing the course.

“This two-day programme has been designed to equip entrepreneurs with hands-on experience in proper financial and business operational practices. Topics are carefully selected to deliver in-depth knowledge of business profitability improvement and cash flow management as well as effective working capital strategies.

“The beneficial entrepreneurs would be able to make better financial and corporate decisions and adhere to standard bookkeeping practices to facilitate access to finance. These are the tools that will help entrepreneurs make informed decisions, navigate the challenges of entrepreneurship, and unlock their full potential,” she said.

The initiative received positive feedback from participants, who praised the interactive and motivating approach, peer-to-peer learning, and networking opportunities.

Participants shared their experiences about how they gained valuable insights into calculating profit margins and maintaining business profitability.

A participant, Abugri Emmanuel, MBA Prime Limited, producer of detergents, shared his excitement for benefitting from the free programme.

The seminar covered key learning areas, including credit management, improving profitability, effective working capital strategies, controlling business cash flow, savings strategy, and record-keeping for informed decision-making.

Bank of Africa is one of Ghana’s foremost SME banking service providers, and IFC is the largest global development institution offering investment, advisory, and asset-management services to encourage private-sector development in less developed countries.

—-

Explore the world of impactful news with CitiNewsroom on WhatsApp!

Click on the link to join the Citi Newsroom channel for curated, meaningful stories tailored just for YOU: https://whatsapp.com/channel/0029VaCYzPRAYlUPudDDe53x

No spam, just the stories that truly matter! #StayInformed #CitiNewsroom #CNRDigital