A new $87 million push has been launched to transform Ghana’s agricultural landscape, fuelled by a bold collaboration between the Mastercard Foundation and CrossBoundary Advisory.

Dubbed the BRIDGE-in Agriculture Programme, the initiative promises affordable capital and technical support to Small and Medium Enterprises (SMEs) in agriculture and allied sectors.

With loan interest rates capped at just 7%, the programme offers a financial lifeline to agribusinesses, especially those led by women and youth.

It’s not just about money. Beneficiaries will also receive hands-on training to build capacity and resilience in a sector long plagued by chronic underinvestment.

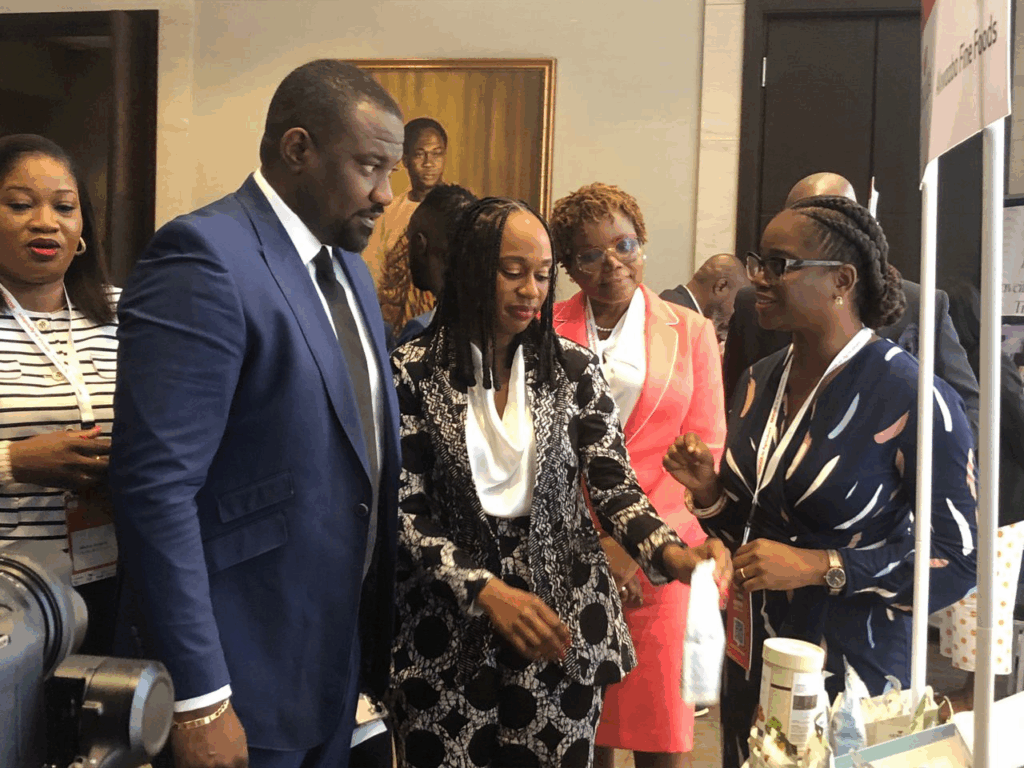

Launched on Thursday, May 29, the event saw Deputy Minister for Agriculture, John Dumelo, describe the programme as a “strategic breakthrough” in Ghana’s pursuit of inclusive, technology-driven agricultural transformation.

“Agriculture employs close to 40% of Ghana’s total workforce and supports about 75% of the rural population,” Mr Dumelo stated.

“Yet, the sector still faces huge challenges—from lack of finance to climate shocks and poor infrastructure.”

He urged young people to seize the opportunity: “Start small, grow gradually, and you will become bigger one day.”

Fanta Conde, Programme Lead for BRIDGE-in Agriculture, said the initiative was crafted in 2023 as a flagship solution by the Mastercard Foundation.

The Foundation is offering partner banks 0% interest repayable grants to lend to agribusinesses at low rates, with embedded guarantees and coverage for higher monitoring costs.

Already, the programme has impacted around 86,000 Ghanaian youth between 18 and 35, linking them to new or improved work opportunities across the agriculture value chain.

Beyond financing, participants are gaining vocational and digital skills through training provided by business development firms.

These include Africa Skills Hub and Mind Builders Africa, with digital platforms supported by Peswa.

Partner banks—Access Bank, Ecobank, Fidelity Bank, First National Bank, Stanbic Bank, and Zenith Bank—are at the centre of delivery, helping ensure loans reach the hands that need them most.

With agriculture central to Ghana’s economy but held back by persistent gaps, the BRIDGE-in Agriculture Programme could be the shockwave the sector has long waited for—driving growth, innovation, and dignity in work for the next generation of farmers and agripreneurs.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.