The government’s transitional agreement for the Damang Mine, which grants Abosso Goldfields Limited (AGL) a 12-month lease extension, has been met with cautious approval by policy think tank ACEP.

However, the group has raised urgent questions about the state’s plan to assume direct operational control after the extension period, demanding transparency on funding, management capacity, and long-term sustainability.

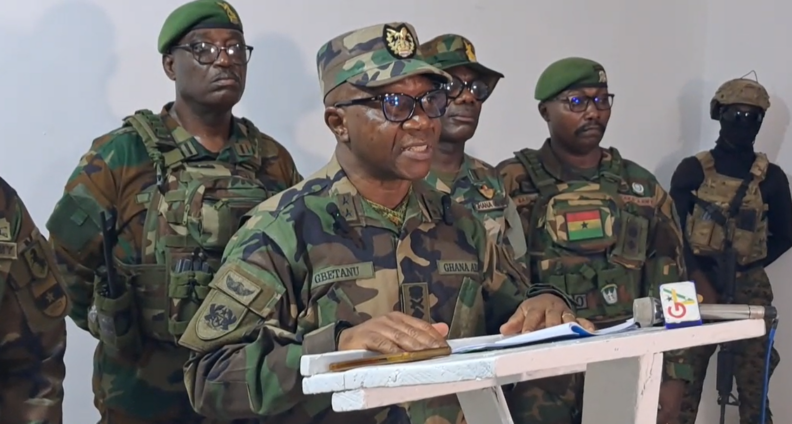

In a press statement issued on April 24, ACEP Executive Director Benjamin Boakye commended the government’s phased approach but warned that mining is a “capital-intensive and high-risk venture” requiring more than “patriotic aspirations.” The think tank outlined several critical concerns.

First, regarding operational readiness, the Minerals Income Investment Fund (MIIF), the likely vehicle for state control, lacks a proven track record in large-scale mine management. ACEP cited MIIF’s struggles with mineral royalty investments as a red flag for assuming Damang’s complex operations.

Second, on the funding gap, the Damang Mine requires over $600 million in additional investment to sustain production. No clear financing strategy has been presented to the public, raising fears of fiscal strain or project collapse.

Third, ACEP referenced Ghana’s troubled state-led mining ventures in the 1970s, urging the government to avoid repeating past mistakes.

ACEP proposed alternative models to mitigate risks. The state could gradually increase ownership while partnering with an experienced investor to share technical and financial burdens. The think tank also called for broader consultations with industry experts, civil society, and local communities to design a sustainable transition plan.

While the government has stressed its commitment to local content and eventual Ghanaian ownership, it has yet to disclose concrete steps to address ACEP’s concerns. The lease extension, pending parliamentary ratification in May 2025, buys time for negotiations but leaves critical questions unanswered.

Analysts warn that mishandling the Damang transition could deter future investors. “Investor confidence hinges on clarity and competence,” said mining economist Dr. Nana Ama Boateng. “If the state falters here, it risks signaling instability in Ghana’s mining sector.”

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.