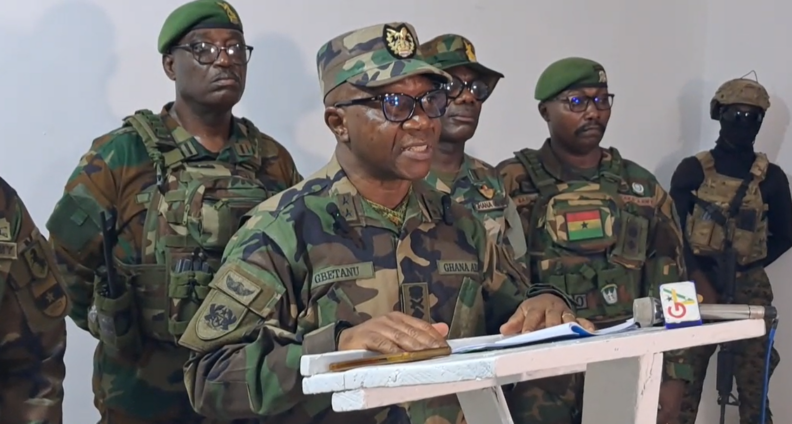

Dr. Johnson Asiama, BoG Governor

The number of staff involved in fraudulent activities in Banks and SDIs rose from 274 in 2023 to 365 in 2024.

This represented an increase of 33%.

Seventy-five percent of the staff were involved in cash theft/suppression, as compared to 77% in 2023.

According to Banks, Specialised Deposit-Taking institutions and Payment Service Providers 2024 Fraud Report, a total of 155 staff were dismissed by the Banks and SDIs for various reasons.

Out of the 155 dismissals, 83, representing 54%, were due to cash theft-related fraud.

The Bank of Ghana stated that it is concerned about the consistent and steady increase in regulated financial institutions’ staff involvement in fraudulent activities in Ghana.

Consequently, Banks and SDIs are required to strengthen their internal controls, enhance staff due diligence mechanisms during recruitment, as well as reinforce continuous in-house staff training on professional conduct, among others.

Again, banks and SDIs are to ensure the prosecution of culprits to serve as a deterrent.

GH¢3m Recovered

In the year under review, the report mentioned that an amount of GH¢3 million representing 4% of the total fraud value at risk of GH¢83 million was recovered.

This reduced the overall value at risk to GH¢80 million.

This was achieved through the collaborative efforts of stakeholders and the implementation of fraud mitigation controls by financial institutions.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.