Ghana Gold Board (GoldBod) CEO Sammy Gyamfi says President John Mahama’s vision for a centralised gold regulation authority is already yielding transformational economic results.

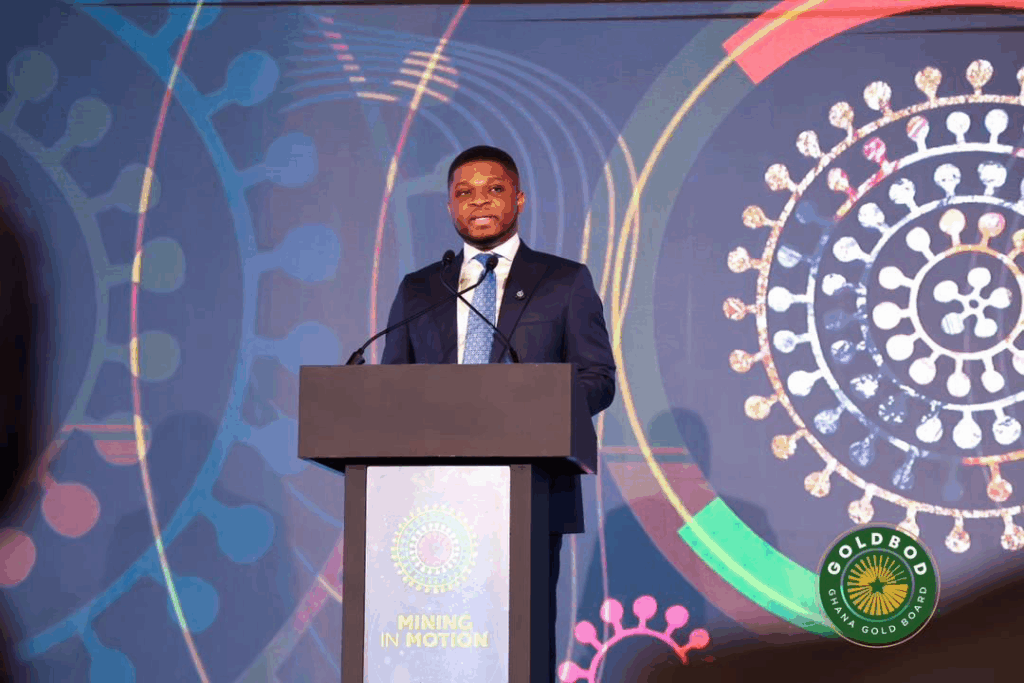

Speaking on Monday at the Mining In Motion Summit in Accra, the CEO revealed that Ghana’s foreign exchange reserves have been boosted by approximately $4 billion, thanks to the GoldBod’s tight regulation and aggressive clampdown on gold smuggling.

“For years, Ghana’s gold potential was sabotaged by a fragmented and poorly regulated trading system,” the CEO said.

“We had a situation where a country rich in gold was like a butcher starved of protein.”

But according to him, the tide has turned decisively under the centralised framework established by President Mahama.

“Thankfully, this hurdle is now a thing of the past thanks to the visionary President of our dear nation, John Dramani Mahama, who conceived the novel idea of the Ghana Gold Board to save a promising sector which has been bleeding.”

He disclosed that between February and May 2025 alone, the Ghana Gold Board had exported 41.5 tonnes of gold from the artisanal small-scale mining (ASM) sector, generating an estimated $4 billion in export revenue for the Bank of Ghana.

“In May alone, we exported 11 tonnes of gold from the ASM sector valued at a staggering $1.172 billion.”

“This is the first time that gold exports from the artisanal small-scale mining sector have exceeded those from large-scale mining. That tells you the massive turnaround this reform is creating,” he said.

The CEO attributed the success to tough regulatory controls, nationwide aggregation systems, and effective monitoring.

“We tightened regulatory controls, launched a ruthless fight against gold smuggling, and deployed effective aggregation systems across the country. Today, we are able to mop up over 90% of ASM gold,” he said.

He further stressed that the GoldBod, which has taken over the mandate of the former Precious Minerals Marketing Company (PMMC), is now the sole legal buyer and exporter of artisanal gold in Ghana.

“No one else has that mandate. The GoldBod is the central agency mandated by law to regulate, buy, assay, refine, and export gold to support forex generation and gold reserve accumulation by the Bank of Ghana.”

He praised President Mahama’s foresight, calling the GoldBod “a redefining era of leadership, regulation, and transformation”.

The CEO said the institution is not resting on its laurels.

“This is just the beginning. Before the end of this year, the GoldBod will roll out a digital traceability technology that will enhance market access, ensure transparency, and raise the value of ASM gold on the international market.”

He also issued a call to international investors to engage with the GoldBod for legitimate and mutually beneficial opportunities in gold trading and value addition.

“Foreigners are not allowed to buy directly from the local market, but they are welcome to partner with licensed Ghanaian aggregators or apply to establish refineries and jewellery factories,” he clarified.

He noted that licensees are subject to strict responsible sourcing requirements and oversight by both the GoldBod and national financial intelligence agencies.

“We are serious about traceability, anti-money laundering, and counter-terrorism financing.”

“The GoldBod is committed to sustainable and responsible gold sourcing. As the President said yesterday, artisanal miners are not enemies of the state. When properly trained and supported, they can be allies of development,” he said.

The CEO’s remarks signal a strong shift in Ghana’s extractive economy and its role in macroeconomic stability.

“With over $4 billion in forex unlocked in just four months, the vision is clearly working,” he concluded.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.