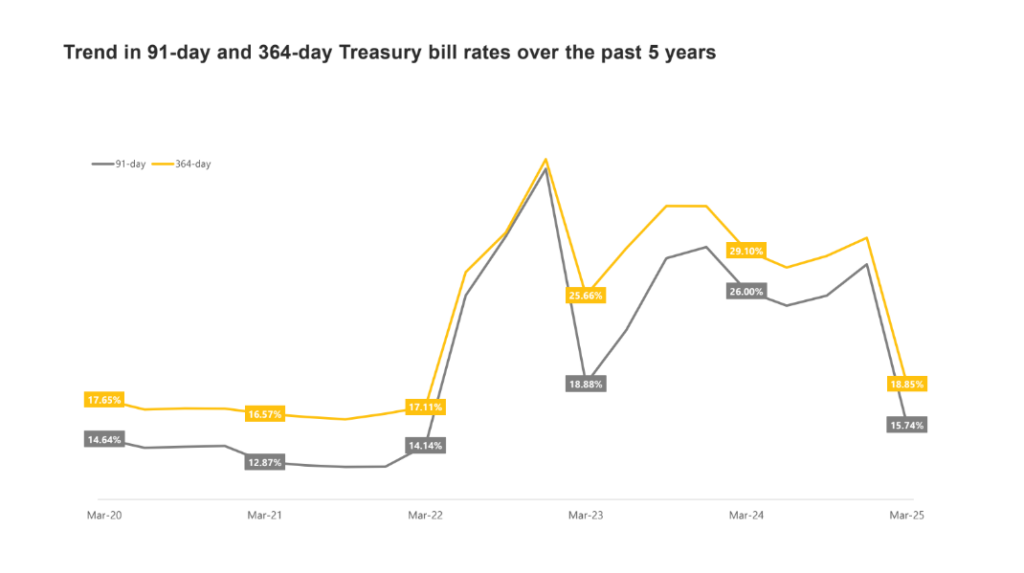

Over the past five years, Ghana’s Treasury bill (T-bill) rates have experienced significant volatility, reflecting the country’s economic struggles and efforts to stabilize its finances. Following a loss of access to international financial markets in early 2022, the Ghanaian government turned to the domestic market, resulting in a surge in T-bill yields.

However, recent interest-saving measures have led to a decline in rates, presenting both challenges and opportunities for investors and the broader economy.

The Surge and Decline of Treasury Bill Rates

In the aftermath of Ghana’s loss of access to international financing markets in early 2022, the country faced rising inflation and escalating debt levels. The government’s reliance on domestic financing options led to an upward spike in treasury bill rates. Notably, the 91-day and 364-day treasury bill yields reached their peak in December 2022, following the announcement of the Domestic Debt Exchange Programme (DDEP). The yields reached 36.18% and 36.10%, respectively.

Following the completion of the first phase of the DDEP, the government implemented interest savings measures during the March 2023 Treasury bill auctions, resulting in a sharp decline in rates. The 91-day bill rate dropped significantly by 1,667 basis points to 18.88%, while the 364-day rate fell by 855 basis points to 25.66%. Despite this short-term relief, Treasury bill rates gradually began to rise again. By the end of 2024, the 91-day rate climbed to 28.04%, and the 364-day rate reached 30.07%.

The start of 2025 saw a return to another round of government interest-saving measures. As a result, Treasury bill rates saw another dramatic decrease, with the 91-day bill rate dropping by 1,230 basis points to 15.74%, and the 364-day bill rate declining by 1,122 basis points to 18.85%. These recent declines suggest that treasury bills may be returning to pre-DDEP levels, signaling relief for both investors and the government.

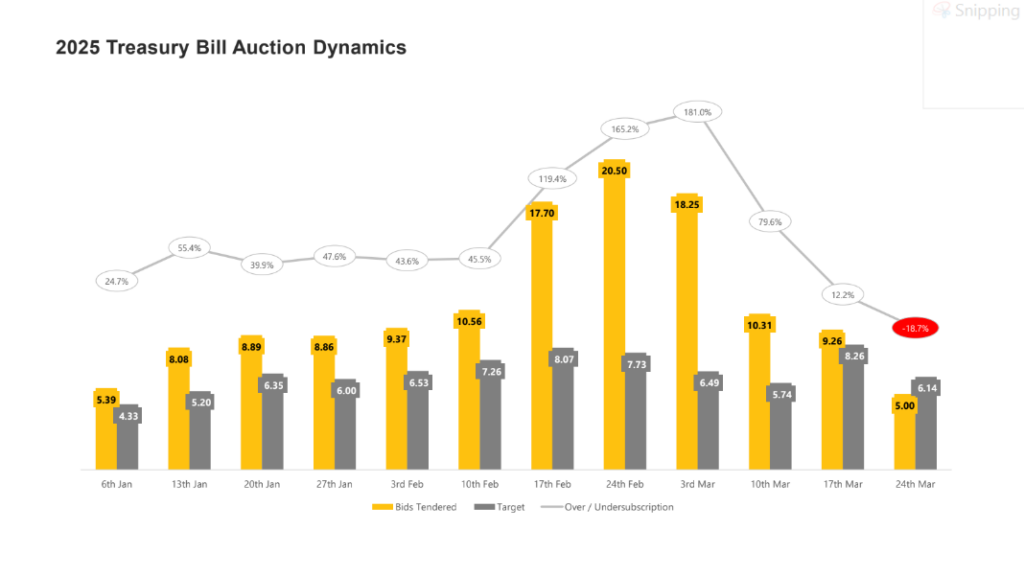

Treasury Bill Auctions in 2025: A Mixed Outlook

The beginning of 2025 has been marked by oversubscription in Ghana’s Treasury bill auctions, indicating strong demand for government securities. So far, the government has raised GHS 132.16 billion, exceeding its target of GHS 78.09 billion by a substantial 45.36%.

However, the most recent auction in 2025 experienced a notable shift, with the government failing to meet its target.

The government aimed to raise GHS 6.14 billion but received only GHS 4.99 billion in bids, resulting in an 18.7% shortfall. This undersubscription may signal a waning investor appetite for treasury bills, potentially reflecting the impact of recent interest-saving measures.

Impact of Lower Treasury Bill Rates on Investors

The sharp reduction in Treasury bill rates is having a profound impact on investor portfolios. Pension funds, corporations, and individual investors that have historically relied on high-yielding treasury bills for relatively safe returns are now facing lower yields.

This may reduce the overall return on investment portfolios, particularly for those heavily invested in government securities.

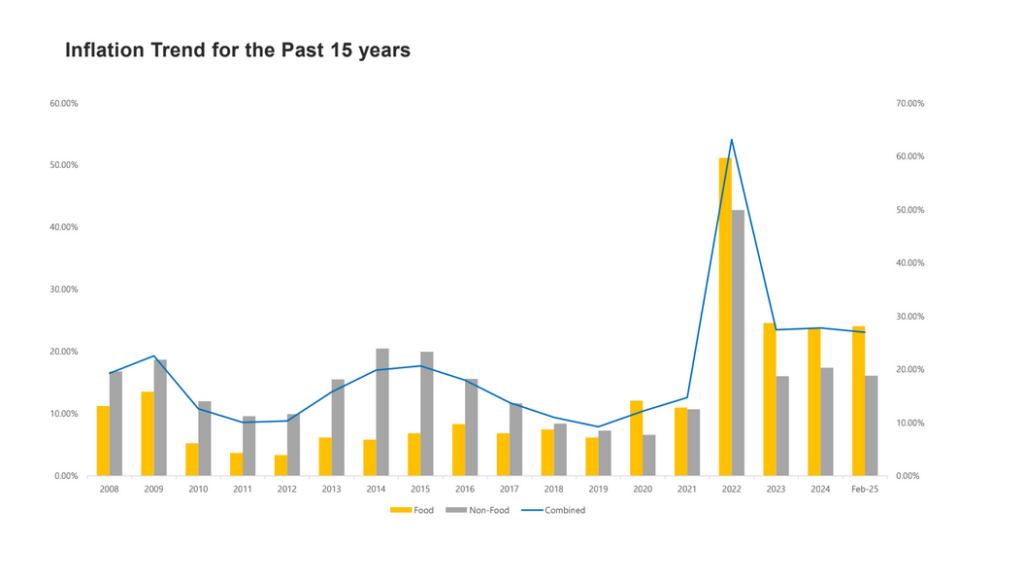

Furthermore, while inflation in Ghana has been trending downward, it remains high at 23.1% as of February 2025. This means that investors are experiencing negative real returns. For example, based on the latest auction results, the 91-day T-bill has a negative real return of 7.36%, while the 364-day T-bill has a negative real return of 4.25%. This creates a challenging environment for investors seeking to preserve and grow their wealth.

As a result, many investors may begin to shift their focus away from treasury bills and toward alternative investments such as equities, real estate, or foreign assets, potentially diminishing future demand for government securities.

Impact on the Government and the Broader Economy

For the government, the decline in Treasury bill rates comes with both advantages and challenges. On the positive side, lower interest rates mean reduced borrowing costs, which could help ease fiscal pressures and create room for other vital expenditures. If the government continues to manage its debt sustainably, it may be able to reduce the budget deficit over time.

However, the reduced demand for treasury bills, particularly in the most recent auction, could complicate the government’s efforts to finance its budget. A decline in investor interest may lead to shortfalls in meeting auction targets, forcing the government to explore alternative (and potentially more expensive) borrowing options.

On a broader scale, the declining rates could have significant economic consequences. First, the shift in investor interest away from low-risk government securities could potentially fuel growth in the stock market. Ghana’s stock market has already seen impressive returns, with the Ghana Stock Exchange delivering a 26.42% year-to-date return.

This shift could also redirect capital toward the private sector, stimulating growth and job creation. Additionally, lower rates may reduce lending rates across the banking sector, potentially boosting borrowing by businesses and consumers. This, in turn, could spur investment and consumption, further contributing to economic growth.

However, there are potential risks. Lower yields on treasury bills may reduce foreign investor interest, particularly as they seek higher returns elsewhere. This could result in capital outflows, increased demand for foreign currencies, and potentially contribute to depreciation of the Ghanaian cedi.

Conclusion

The evolution of Ghana’s Treasury bill rates over the past five years highlights the country’s ongoing economic struggles and efforts to regain fiscal stability. While recent interest-saving measures have brought temporary relief, the longer-term effects of these measures on investor behavior, government financing, and the broader economy remain uncertain. As the government navigates these challenges, its ability to balance investor interests with fiscal responsibility will be key in ensuring sustainable economic growth and stability.

By Nelson Cudjoe Kuagbedzi, Head of Finance, UMB Capital.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.