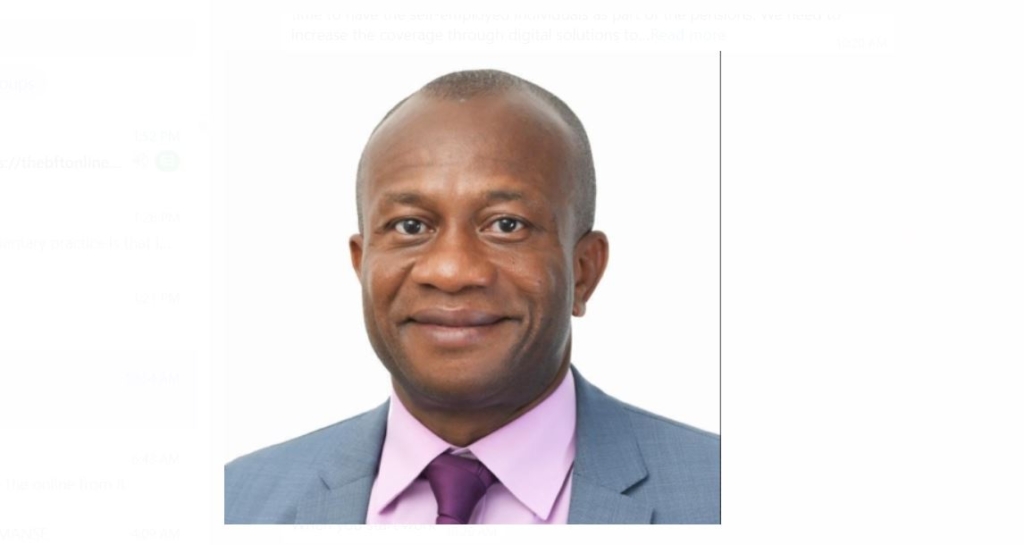

The Chief Executive Officer of the National Pensions Regulatory Authority (NPRA), Christopher Boadi-Mensah, has underscored the importance of a robust and inclusive pension system that caters to both the formal and informal sectors of the economy.

He emphasised the need for innovative micro-pension schemes and digital solutions to expand coverage and ensure financial security for all Ghanaians.

“We need a robust and effective pension system that will be responsible for the welfare of all employees. It is usually targeted at the formal sector, and this is the time to have the self-employed individuals as part of the pensions. We need to increase the coverage through digital solutions to ensure financial security,” he said.

He was addressing a pivotal stakeholder engagement that brought together pension managers, fund managers, and custodians to discuss the future of Ghana’s pension sector and ways of restoring confidence in the system.

Mr Boadi-Mensah further acknowledged the challenges posed by economic fluctuations, including inflation and debt restructuring, and called for stronger governance and transparency in fund management.

He stressed the urgency of addressing delays in the payment of benefits and improving employer compliance, noting that trust in the pension system is crucial for its sustainability.

“It is obvious that the economic situation of the country, such as inflation and debt restructuring, has been a challenge for this sector. This has resulted in delays in the payment of benefits, which has reduced trust and employer compliance,” Mr Boadi-Mensah stated.

He reaffirmed the Authority’s commitment to a hands-on, collaborative approach to policy implementation and regulatory oversight. Nonetheless, Mr Boadi assured stakeholders that the NPRA would not be a passive regulator but an active partner in driving reforms that benefit both industry players and pension contributors.

“This is not just about policies; it’s about people’s lives. We as stakeholders must work together in building a pension system that guarantees financial dignity in retirement. We must take steps toward a more resilient and inclusive pension framework for Ghana,” he said.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.